3 Signs Your Risk Adjustment Process is Broken—and How to Fix It

As healthcare providers shift from fee-for-service models to value-based care (VBC), the stakes have never been higher. For providers taking on risk in VBC contracts, financial success depends on accurate risk adjustment, which ensures reimbursement aligns with the complexity of patient populations.

However, the traditional risk adjustment process has devolved into a “game” of hunting for as many HCC codes as possible, often at the expense of efficiency and accuracy. With the introduction of CMS v28, this outdated approach is no longer viable. Providers who continue to rely on the same strategies risk significant reimbursement losses.

Let’s explore what’s changing, how it impacts you, and what you need to do to fix it.

The Challenges of Risk Adjustment in Value-Based Care

In the transition to value-based care, providers must deliver better outcomes while keeping costs in check. For those taking on risk, accurate risk adjustment is critical because it ensures payments reflect the true health status of patients.

Historically, this process has been flawed:

- Incomplete Data: Providers often lack a full clinical picture, leading to missed diagnoses or inaccurate coding.

- Inefficient Workflows: Labor-intensive “chart chasing” drains resources and delays reimbursements.

- Focus on Maximizing HCC Codes: Many providers rely on coding as many Hierarchical Condition Categories (HCCs) as possible to boost their scores, prioritizing quantity over quality.

With the introduction of CMS v28, this coding-centric approach will no longer work. Reimbursements are about to drop dramatically for providers who fail to adapt to the new model.

What’s Changing with CMS v28

CMS v28 introduces sweeping changes to the Medicare Advantage risk adjustment model, designed to improve accuracy and curb gaming. Here’s what providers need to know:

- Fewer Codes: More than 2,000 ICD-10 codes have been removed, significantly narrowing the list of diagnosable conditions that map to HCCs.

- Increased Scrutiny: Codes that remain are subject to stricter documentation requirements, meaning unsupported diagnoses are more likely to be denied.

- Focus on Chronic and Serious Conditions: CMS is shifting toward conditions with a clear impact on healthcare costs and outcomes, penalizing vague or incidental diagnoses.

With these changes, providers can no longer rely on volume-based coding. Instead, they must ensure that every diagnosis is accurate, well-documented, and clinically supported. Those who fail to adapt will see reimbursement rates plummet.

Identifying Gaps in Your Risk Adjustment Process: 3 Signs to Look For

If your risk adjustment outcomes are falling short, here are three key areas to examine:

1. Inefficient Record Retrieval

Are you spending hours chasing charts and patient records? Manual workflows not only waste time but also increase the likelihood of missed or incomplete data. Efficient risk adjustment starts with seamless access to comprehensive patient records.

2. Outdated Coding Processes

If your team struggles with coding errors or relies on legacy systems, v28’s stricter requirements will magnify the problem. Misaligned workflows and poor coding precision lead to denied claims and lost revenue.

3. Underperforming Technology

Is your EHR hindering more than helping? Many systems fail to deliver actionable insights or require additional tools for effective risk adjustment. Without the right technology, providers lack the visibility they need to identify risk adjustment opportunities.

How to Fix Your Risk Adjustment Process

To thrive under CMS v28 and future risk adjustment models, providers must take a proactive, data-driven approach. Here’s how to get started:

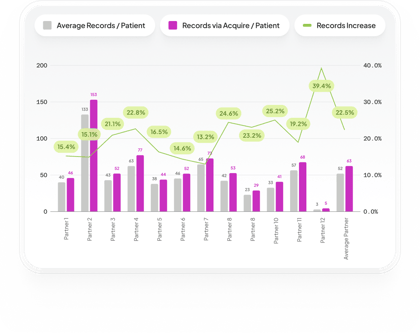

1. Invest in Comprehensive Data Access

Providers need a complete clinical picture to make informed decisions. Partner with platforms that aggregate and normalize data from diverse sources, ensuring every patient record is accurate and actionable.

2. Modernize Your Coding Workflow

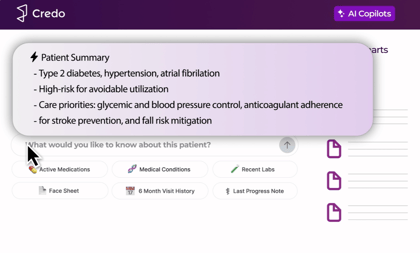

AI-driven solutions can be an extremely powerful tool to sift through complex patient data to quickly identify coding opportunities and flag potential errors, ensuring compliance with CMS v28’s stricter requirements. These tools save time and boost accuracy by automating the most error-prone parts of the process.

3. Integrate Advanced Risk Adjustment Solutions

If it doesn’t integrate, it won’t be adopted. Look for solutions that integrate seamlessly with your EHR, allowing you to streamline record retrieval, coding, and submission all in the place you spend your team each day.

The Path to Better Risk Adjustment Starts Here

Your risk adjustment process doesn’t just impact your bottom line—it shapes the quality of care you can deliver. Under CMS v28, outdated processes will no longer cut it. By addressing inefficiencies, modernizing workflows, and leveraging advanced solutions, providers can navigate these changes with confidence.

Credo’s platform is designed to help providers thrive in value-based care. With unparalleled data access and cutting-edge analytics, we simplify risk adjustment, enhance accuracy, and improve both financial and patient outcomes.

Ready to transform your risk adjustment process? Schedule a demo today to learn how Credo can help your practice adapt to CMS v28 and beyond.

Back to blog